It’s easy to see why DIY estate planning has become so popular. A quick search online leads to dozens of websites offering downloadable wills, trusts, and powers of attorney, often for less than what you’d pay for a night out. The promise is appealing: save money, get it done quickly, and stay in control.

But what looks like a shortcut can turn into a legal and financial trap. Estate planning touches nearly every part of your life—your assets, your healthcare decisions, and your loved ones. Cutting corners here can mean your wishes aren’t followed. Or worse, your family ends up in court.

Let’s take a closer look at the dangers of DIY estate planning, and where they tend to go wrong.

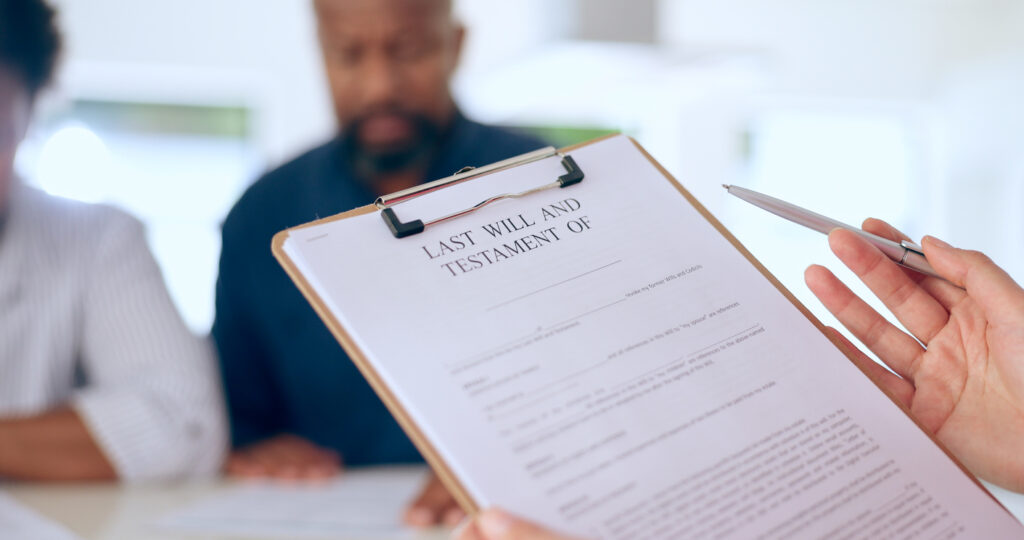

A real example: a person downloaded a do-it-yourself trust and a DIY will. Unfortunately, the trust listed assets on the Trust’s schedule of assets, which should have been distributed according to the terms of the trust, while the Will listed the same assets and named specific, and slightly different, people who should inherit each asset. The two documents contradicted each other and left confusion for the heirs and beneficiaries. To make matters worse, the Will, which was executed when the Decedent was in a long-term relationship, named a girlfriend as a beneficiary of a large portion of the estate, but she was no longer the girlfriend of the Decedent when he passed. Both documents were valid legal documents, so the family ended up in probate court fighting over who was supposed to get what. The estate was tied up for over two and a half years.

In another case, a woman had a professionally prepared estate plan, but near the end of her life, she made handwritten notes on the documents to reflect new wishes, without formally updating the documents with her estate planning attorney. When she passed, those notes became the subject of intense family disputes as some beneficiaries’ shares were significantly increased, while others’ shares were diminished or eliminated by the handwritten notes. Her children and grandchildren argued in court over whether the notes should be considered an amendment to the trust, or could/should be ignored. They ended up spending thousands on legal fees.

These are not rare cases. They are the kind of stories that Ferguson Law Group attorneys see routinely, and these costly results and family strife are entirely preventable.

Writing down who gets the house and who gets the car are important parts of any plan, but proper estate planning is far more wide-reaching. It’s a formal legal process designed to carry out your intentions, protect your assets, and prepare for worst-case scenarios.

At a minimum, a complete plan usually includes:

And here’s where things get complicated. Every state has its own rules about how these documents need to be written, signed, and executed. Something as simple as missing a witness signature can invalidate a will in some states.

According to AARP, only 51% of Americans over the age of 50 have a legal will. Those who try to tackle it on their own often don’t realize what’s at stake. A document that’s slightly off—poorly worded, improperly signed, or not coordinated with other parts of the plan—can unravel the best intentions of the testator..

Here are some of the most common DIY mistakes:

And when problems crop up? They often get sorted out in probate court, publicly, slowly, and expensively. One recent study found that probate fees can eat up 3% to 7% of an estate’s value. For a $500,000 estate, that’s up to $35,000 in costs that might’ve been avoided.

Working with an estate attorney might seem like overkill until you understand what they really do. It’s not just about filling out forms. It’s about identifying risks you may not see, creating a plan that works for your unique situation, and making sure everything is legally enforceable.

For instance, a professional will ensure that the important documents in your life, such as business ownership agreements, prenuptial agreements, or employee stock purchase plans, work seamlessly with the estate plan documents so there is no ambiguity or confusion about your wishes. They’ll help coordinate your estate plan with your insurance policies and retirement accounts. They’ll ask the questions you haven’t thought to ask, like what happens if a beneficiary dies before you, or how to protect a disabled heir’s inheritance from impacting their government benefits.

It’s a bit like building a house. You could buy some lumber, watch a few YouTube videos, and try to do it yourself. But unless you know how the plumbing, wiring, and structural supports all work together, the result probably won’t be something you’d want to live in, especially during a storm.

The dangers of DIY estate planning are not always financial. It’s often the stress, confusion, and conflict left behind for your family that causes the most damage. Ambiguous wills have sparked lawsuits between siblings. Forgotten documents have caused grieving spouses to lose access to joint bank accounts. A plan that you thought would bring clarity can leave your loved ones with more questions than answers.

Legal battles over estates aren’t just for the ultra-wealthy. Even modest estates can become battlegrounds if the documents are flawed. And once a family relationship is fractured in probate court, it’s hard to put it back together.

There are situations where a DIY estate plan could be enough. If you’re single, have minimal assets, and no dependents, a basic will from a reputable online source might get the job done, at least temporarily.

But once your situation gets even slightly more complex, the risk curve rises steeply. Here are signs you probably shouldn’t go the DIY route:

In these cases, a skilled estate planning lawyer can save you far more than their fee in the long run.

While it may seem easy and cost-effective, the dangers of DIY estate planning cannot be understated, and often lead to costly mistakes. A simple online template can’t provide the same protection or peace of mind as a professionally constructed plan.

If you are unsure about your estate plan or need help ensuring it’s properly set up, Ferguson Law Group is here to help. Our attorneys specialize in creating estate plans that protect both your assets and your family’s future.

Don’t leave your legacy to chance—contact us today to start building an estate plan that will stand the test of time.

DIY estate planning can lead to mistakes, omissions, or ambiguities that could cause confusion or legal disputes after your death. It may also fail to comply with state laws, making the plan invalid.

DIY wills often fail due to improper execution, unclear language, or failure to address all necessary assets and contingencies. They may not be legally binding if not correctly formatted or signed according to state requirements.

An estate planning attorney ensures that your documents are legally sound, without legal ambiguities, customized to your unique family and asset structure, and compliant with state laws. They can also help minimize tax liabilities and address complex family dynamics.